TIFFANY N. SANTOS and SHANNON OLIVER, July 2016 —

IRS Issues Early Affordable Care Act (“ACA”) Draft Forms 1094 and 1095-C for 2016 Coverage and New Proposed Rules for Section 6055 Reporting by Providers of Coverage

In early July 2016, the IRS issued early drafts of the forms that applicable large employers must provide to employees in early 2017 and file with the IRS to report coverage offered to their full-time employees in calendar year 2016, draft Forms 1094 and 1095-C. While the drafts are substantially similar to the forms relating to 2015 coverage, the final forms will likely be different as the IRS has invited comments about the drafts and has not yet issued any instructions, draft or final, for the 2016 forms.

Section 6055 Reporting Proposed Rules

On August 1, 2016, the IRS issued new proposed regulations relating to the reporting of “minimum essential coverage” (“MEC”) provided to individuals under Section 6055 of the Internal Revenue Code (the “Code”) by health insurers, certain employers and other providers of coverage (for example, multiemployer plans that provide self-insured health plan coverage). Such reporting is accomplished via Forms 1094 and 1095-B. The proposed rules invite comments from the public and include guidance on the following items of relevance to plan sponsors:

- Reporting of catastrophic plans

Insurers and the Exchanges were not required to report coverage provided under a catastrophic plan in 2015. The proposed rules provide for voluntary reporting in 2017 of such coverage provided in 2016 and mandate reporting in 2018 for coverage provided in 2017.

- Solicitation of “taxpayer identification numbers” (“TINs”)

The proposed regulations state:- Reporting entities may rely on the proposed rules and Notice 2015-68 regarding the timing of requests for TINs to avoid penalties for failing to report a TIN for an individual on the Form 1095-B (according to the prior guidance, the initial solicitation must be made at an individual’s first enrollment, the second solicitation at a reasonable time thereafter, and the third by December 31 of the year following the initial solicitation).

The proposed regulations provide:- The initial solicitation may be made as part of the application for coverage (including an application to add an individual to existing coverage);

- The first annual solicitation for missing TINs (i.e., the second solicitation overall) must be made no later than 75 days after the date the plan receives the individual’s substantially complete application for coverage (or, in the case of retroactive coverage, within 75 days after the determination of retroactive coverage is made);

- The second annual solicitation (the third solicitation overall) must be made December 31 of the year following the year the “account” was opened (i.e., the date the plan received a substantially complete application for coverage).

- The proposed regulations clarify that a plan may make TIN solicitations to the responsible individual for a plan (a plan is not required to make separate solicitations from the responsible individual for each covered individual nor must it contact each covered individual directly).

- Reporting entities may rely on the proposed rules and Notice 2015-68 regarding the timing of requests for TINs to avoid penalties for failing to report a TIN for an individual on the Form 1095-B (according to the prior guidance, the initial solicitation must be made at an individual’s first enrollment, the second solicitation at a reasonable time thereafter, and the third by December 31 of the year following the initial solicitation).

- Clarification of plans that are NOT subject to reporting

The proposed regulations clarify:- If an individual is enrolled in a self-insured group health plan and self-insured health reimbursement arrangement (“HRA”) provided by the same employer, the employer is required to report only one type of coverage for that individual. If such individual retires or otherwise drops coverage under the non-HRA group health plan mid-year and is covered only under the HRA for the remainder of the year, the employer must report coverage under the HRA for the months after the individual’s retirement or dropping of non-HRA coverage;

- An employer MUST report the supplemental coverage it offers (for example, self-insured HRA coverage) if it is only offered to individuals who are also covered by other MEC, including Medicare, TRICARE, Medicaid or certain employer-sponsored coverage (for example, a non-HRA group health plan provided by the employer of the employee’s spouse), for which reporting is required under Section 6055.

2017 Health Savings Accounts and Interplay with 2017 ACA Maximum Out-of-Pocket Limits

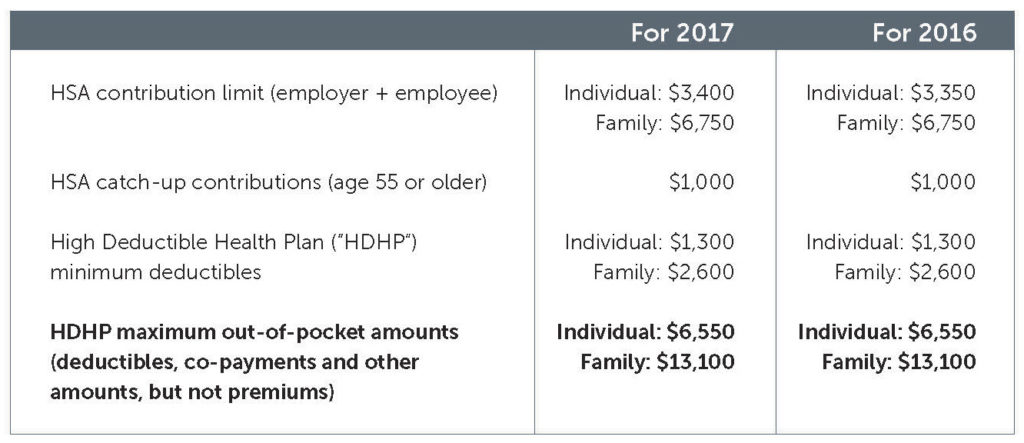

In Revenue Procedure 2016-28, the IRS announced the inflation-adjusted amounts for health savings accounts (“HSAs”) for the 2017 calendar year. The following chart provides the amounts for 2017 and how they compare to the 2016 limits:

A

Interplay with Affordable Care Act (“ACA”) Maximum Out-of-Pocket Limits

For the plan year beginning in calendar year 2017, the maximum out-of-pocket limits on cost-sharing for non-grandfathered health plans are $7,150 for self-only coverage and $14,300 for other than self-only coverage. To help ensure enrollees can contribute to their respective HSAs in 2017, a sponsor of a non-grandfathered high deductible health plan must apply the lower HSA/HDHP out-of-pocket limits referenced above to its plan as opposed to the 2017 ACA limits.

ACA Guidance — FAQs Part 31

The following tidbits from recently issued FAQs about ACA implementation prepared jointly by the Department of Labor (“DOL”), Internal Revenue Service (“IRS”) and Department of Health and Human Services (“HHS”) may be of interest to plan sponsors, in particular those with self-insured plans:

- Coverage of Preventive Care Services

- Coverage of Preventive Care Colonoscopies —

The FAQs clarify that preparation services that are integral to a preventive screening colonoscopy pursuant to the USPSTF recommendations, such as bowel preparation medications, must be covered by a non-grandfathered health plan without any cost sharing, provided the service or medication is medically appropriate and prescribed by a health care provider. - Coverage of FDA-Approved Contraceptives —

In previous FAQs issued on May 11, 2015, the Departments stated that a plan may use reasonable medical management techniques within a specified method of contraception to determine which one form of contraception it must cover without any cost-sharing for any of 18 FDA-approved methods of preventive care contraception that a plan must cover. The Departments also stated that a plan must implement an easily accessible, transparent, and sufficiently expedient exceptions process that is not unduly burdensome for participants or providers to use so that a particular service or FDA-item that a provider recommends because of medical necessity can be covered without cost sharing (medical necessity considerations include side effects, differences in permanence and reversibility, and ability to adhere to the appropriate use of the item or service). The recent FAQs clarify that a plan may develop a standard form with instructions for providers and state that the Medicare Part D Coverage Determination Request Form may serve as a model for such a form.

- Coverage of Preventive Care Colonoscopies —

- Coverage of Out-of-Network Emergency Services

The ACA prohibits non-grandfathered health plans from imposing cost-sharing on out-of-network emergency services in amounts that are greater than what is imposed for in-network emergency services. A plan can satisfy this requirement if it provides benefits in an amount at least equal to the greatest amount determined under the following “minimum payment standards” (adjusted for in-network cost sharing): (i) the median amount negotiated with in-network providers for emergency services; (ii) the amount for emergency services calculated using the same method the plan generally uses to determine payments for out-of-network providers (for example, the usual, customary and reasonable [UCR]amount); or (iii) the amount that would be paid under Medicare for the emergency service. The FAQs clarify that the documentation and data used to calculate each of the above minimum payment standards are considered “instruments under which a plan is established or operated” and, therefore, must be furnished to a plan participant within 30 days of a request made under ERISA Section 104(b) and Labor Regulations Section 2520.104b-1. Such information must also be provided to a participant free of charge upon such participant’s request for documents, records and other information relevant to her claim in accordance with the DOL’s claims regulations and internal and external review requirements under the ACA (Public Health Service Act Section 2719).

- Coverage for Routine Costs Furnished in Connection with Participation in a Clinical Trial

Under the ACA, non-grandfathered plans must cover the routine patient costs for items and services that are furnished in connection with an individual’s participation in an approved clinical trial that relates to the prevention, detection, or treatment of cancer or another life-threatening disease or condition. The FAQs clarify that if a plan generally covers chemotherapy to treat cancer, the plan may not limit coverage for chemotherapy for an individual if it is provided in connection with the individual’s participation in an approved clinical trial (for example, for a new anti-nausea drug). “Routine patient costs” also includes costs related to items and services to diagnose or treat complications or adverse events arising from an individual’s participation in an approved clinical trial, provided the costs are otherwise covered under the plan for individuals who are not participating in approved clinical trials.

- The FAQs also provide guidance on the items that a provider of coverage or participant may wish to request from a plan to determine if the health plan has complied with the Mental Health Parity and Addiction Equity Act of 2008 (i.e., summary plan description; specific underlying processes, strategies, evidentiary standards and other factors considered by the plan for determining whether to apply a “nonquantitative treatment limitation” [for example, a prior authorization requirement that applies to mental health treatment, but not to a medical treatment]; how the limitation has been applied to any medical/surgical benefits; and any analyses performed by the plan as to how the limitation applies with the law).

New Proposed Regulations Revising Annual Form Information Returns (Form 5500)

On July 21, 2016, the DOL, IRS and PBGC jointly issued proposed rules that significantly revise the annual information returns filed by employee benefits plans via the Form 5500. Of note to health and welfare plans, proposal eliminates the current exemption from annual filing for small insured and self-insured unfunded welfare benefit plans (i.e., plans of employers with fewer than 100 employees). The intent is to provide the above referenced agencies with critical information regarding such “small plans” and facilitate their oversight of such plans.

ACA Nondiscrimination Final Rules — Section 1557

On May 18, 2016, the Department of Health and Human Services (“HHS”) issued final rules implementing the Section 1557 of the Affordable Care Act which prohibits discrimination on the basis of race, color, national origin, sex, age or disability in certain health programs and activities. The nondiscrimination rule applies to the programs administered by the Federally-facilitated Marketplaces/ Exchanges or a State-based Marketplace/Exchange and to all health programs and activities, any part of which receives Federal financial assistance administered by HHS. This means that if an employer or plan sponsor receives a subsidy from the Federal government, for example, a Medicare Part D prescription drug subsidy, its plan is subject to the nondiscrimination rules implementing Section 1557. Of note to employers and other plan sponsors, the final rules require the following among other provisions:

- The provision of language assistance services, free of charge, to facilitate meaningful access to individuals with limited English proficiency who are eligible to be served or likely to be encountered by the health plan. This includes offering a qualified interpreter for oral interpretations and translation by qualified translators of written documents (this would include the summary plan description);

- The taking of appropriate steps to ensure communications with individuals with disabilities are as effective as communications with others in health programs and activities;

- Ensuring that any health programs and activities that are provided through electronic and information technology are accessible to individuals with disabilities, unless doing so would result in undue financial and administrative burdens or fundamental alteration in the nature of the health programs or activities;

- Prohibiting sex discrimination in health care by various measures, including:

- Requiring that women must be treated equally with men in the health care they receive;

- Prohibiting the denial of health care or health coverage based on an individual’s sex, including discrimination based on pregnancy, gender identity, and sex stereotyping;

- Prohibiting a plan from denying or limiting health services that are ordinarily or exclusively available to individuals of one sex, to a transgendered individual based on the fact that the individual’s sex assigned at birth, gender identity, or gender otherwise recorded is different from the one to which such health services are ordinarily or exclusively available;

- Prohibiting any categorical coverage exclusion or limitation for all health services related to gender transition or the denial or limitation of coverage of a claim or the imposition of additional cost sharing for specific health services related to gender transition if such denial, limitation, or restriction results in discrimination against a transgender individual; and

- The provision of a notice that the plan complies with the nondiscrimination law and makes available accessibility assistance, language assistance services, how to obtain such aids, and how to file a grievance or complaint with HHS or the plan. Such notice must be provided within 90 days of the effective date of the final rules and include taglines describing the availability of language assistance in the top 15 languages spoken by individuals with limited English proficiency of the State(s) where the plan’s participants are located. The notice must be included in “significant publications and significant communications targeted to beneficiaries, enrollees, applicants and members of the public” — these likely include the summary plan description, summary of material modifications, and initial and annual enrollment materials. The final rules include a sample notice that includes these taglines.

If you have any questions regarding the foregoing, please contact the author of this article.