SHANNON OLIVER and KEVIN E. NOLT, October 2016

The Internal Revenue Service has announced the annual cost-of-living adjustments applicable to dollar limitations for pension plans and other items for Tax Year 2017. Many of the pension plan limitations were increased, as the increase in the cost-of-living index met the statutory limits that initiate their adjustment. However, some limitations remain unchanged. Below is a summary of some of the limitations.

Limitations that Have Increased

- The limitation on the annual benefit under a defined benefit plan increased from $210,000 to $215,000. (Code section 415(b)(1)(A)).

- The limitation for defined contribution plans increased from $53,000 to $54,000. (Code section 415(c)(1)(A)).

- For participants who separate from service before January 1, 2017, the defined benefit limitation under Section 415(b)(1)(B) is computed by multiplying the participant’s compensation limitation, as adjusted through 2016, by 1.0112. (Code section 415(b)(1)(B), Regs. section 1.415(d)-1(a)(2)(ii)).

- The dollar limitation used for the definition of “key employee” in a top-heavy plan is increased from $170,000 to $175,000. (Code section 416(i)(1)(A)(i)).

- The annual compensation limit increased from $265,000 to $270,000 (Code sections 401(a)(17), 404(l),408(k)(3)(C), and 408(k)(6)(D)(ii)).

- The dollar limitation for determining the maximum account balance in an employee stock ownership plan subject to a 5-year distribution period is increased from $1,070,000 to $1,080,000, while the dollar amount used to determine the lengthening of the 5-year distribution period is increased from $210,000 to $215,000. (Code section 409(o)(1)(C)(ii)).

- The annual compensation limitation for eligible participants in certain governmental plans that, under the plan as in effect on July 1, 1993, allowed cost-of-living adjustments to the compensation limitation under the plan to be taken into account, increased from $395,000 to $400,000 (Code section 401(a)(17)).

- The dollar amount used to determine excess employee compensation with respect to a

single-employer defined benefit pension plan for which the special election under section

430(c)(2)(D) has been made is increased from $1,106,000 to $1,115,000 (Code section

430(c)(7)(D)(i)(II)).

A

Limitations that Remain Unchanged

- The maximum amount of elective deferrals that may be made to 401(k) plans, 403(b) plans, simplified employee pensions (“SEPs”), and 457(b) plans remains unchanged at $18,000.

(Code sections 402(g)(1) and 457(e)(15)).

- The maximum amount of catch-up contributions that individuals aged 50 or over may make to 401(k) plans, 403(b) plans, SEPs, and governmental 457(b) plans remains unchanged at $6,000 (Code section 414(v)(2)(B)(i)).

- The maximum amount of catch-up contributions that individuals aged 50 or over may make to SIMPLE 401(k) plans or SIMPLE retirement accounts remains unchanged at $3,000 (Code section 414(v)(2)(B)(ii)).

- The limitation used in the definition of “highly compensated employee” remains unchanged at $120,000 (Code section 414(q)(1)(B)).

- The compensation amount used for determining required participation in SEPs remains unchanged at $600 (Code section 408(k)(2)(C)).

- The limitation on the exclusion for elective deferrals to SIMPLE retirement accounts remains unchanged at $12,500 (Code section 408(p)(2)(E)).

- The compensation amounts used in defining “control employee” for fringe benefit valuation for Board or shareholder-appointed, confirmed, or elected officers of the employer remains unchanged at $105,000. The compensation amount used for all other employees of the

employer also remains unchanged at $215,000 (Regs. sections 1.61-21(f)(5)(i) and 1.61-21(f)(5)(iii)).

- The limitation concerning the qualified gratuitous transfer of qualified employer securities to an employee plan remains unchanged at $45,000 (Code section 664(g)(7)).

- The dollar limitation on premiums paid with respect to qualifying longevity annuity contract remains unchanged at $125,000. (Code section 1.401(a)(9)-6 and Regs. section A-17(b)(2)(i)).

- The $1,000,000,000 threshold the Code utilizes to determine whether a multiemployer plan is a systematically important plan is adjusted using the cost-of-living adjustment. After applying the rounding rule, the threshold used to determine whether a multiemployer plan is a systemically important plan remains unchanged at $1,012,000,000. (Code section 432(e)(9)(H)(v)(III)(aa) and 432(e)(9)(H)(III)(bb)).

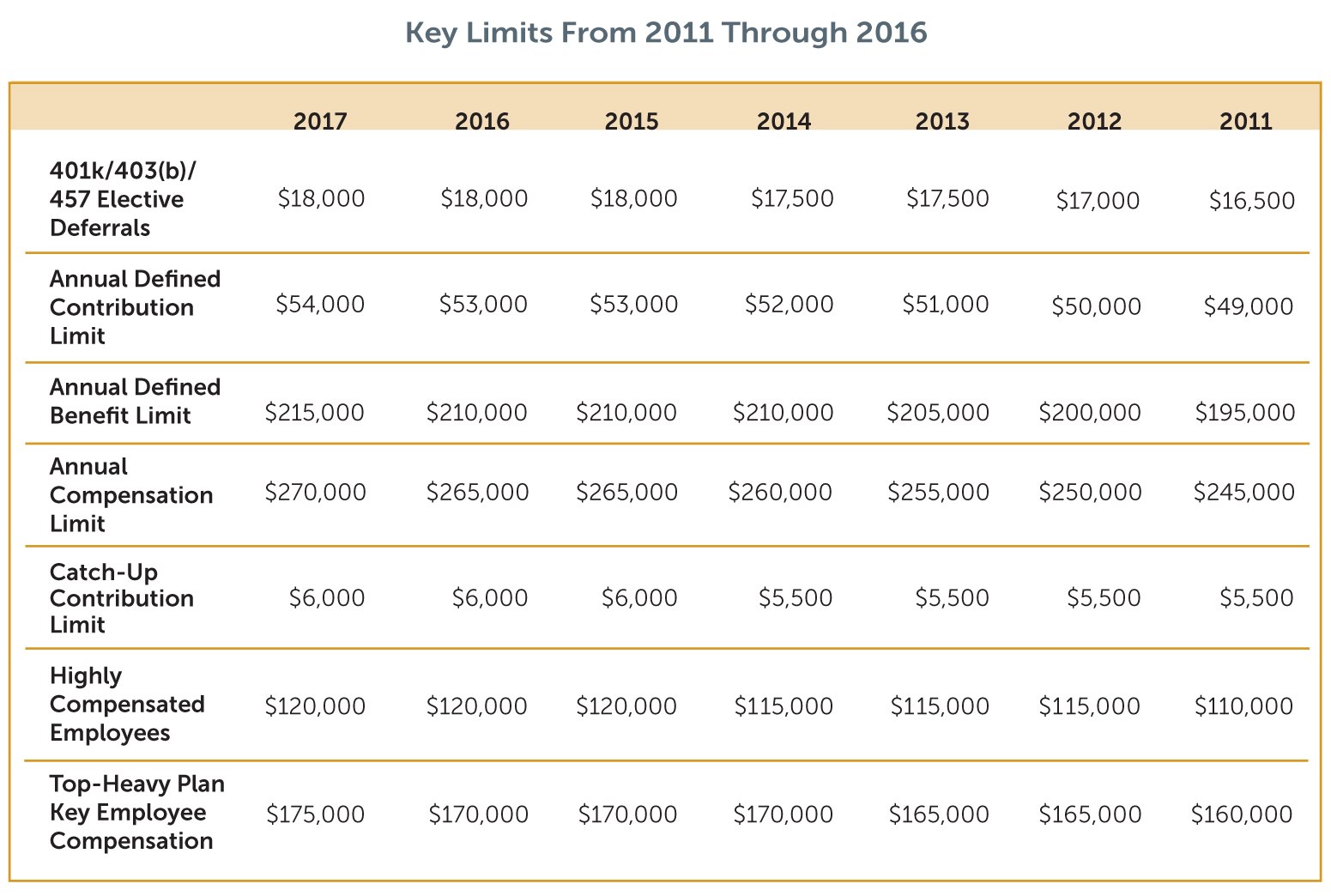

The following chart is a quick reference guide to key limits.