TIFFANY N. SANTOS and SHANNON OLIVER, November 2016

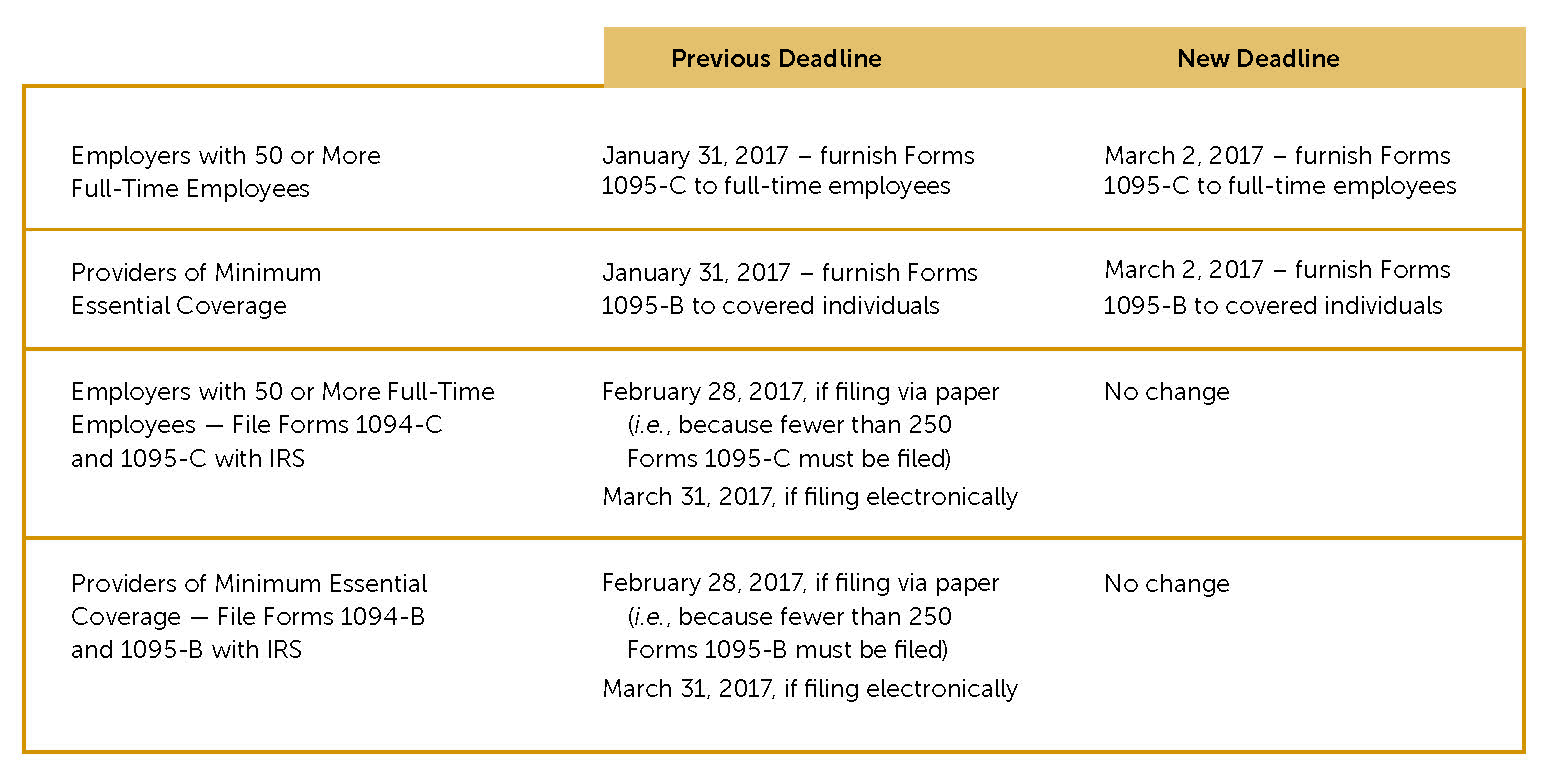

In a welcome surprise, the Internal Revenue Service (the “IRS”) on November 18, 2016, released Notice 2016-70 which delays the deadline from January 31, 2017 to March 2, 2017 for employers to furnish the Form 1095-C to full-time employees and for providers of health coverage (such as insurers and multiemployer trusts that provide self-funded health plan benefits) to furnish the Form 1095-B to covered individuals. While employers and providers of “minimum essential coverage” (“MEC”) will still have to file the forms with the IRS by the original February 28, 2017 deadline if filing by paper, or March 31, 2017 if filing electronically, the 30-day delay for furnishing statements to employees and covered individuals gives employers and plans more time to help ensure forms are prepared properly and completely.

A

A

Although no automatic extension is available for filing with the IRS, employers and providers of MEC may obtain an automatic 30-day filing extension by submitting the Form 8809 to the IRS on or before the filing deadline (see Treasury Regulations Section 1.6081-1; Temp. Treasury Regulations Section 1.6081-8T). An additional 30-day filing extension may be granted by the IRS in the event of certain hardship conditions if the Form 8809 is submitted before the original automatic 30-day filing extension expires and the filer explains in detail why the extension is necessary.

Good Faith Transition Relief from Section 6721 and 6722 Penalties

Under Sections 6721 and 6722 of the Internal Revenue Code, penalties may be imposed on employers and providers of MEC who fail to comply with the reporting requirements of Section 6055 (requirement to furnish and file the Forms 1094-B and 1095-B) by providers of MEC or Section 6056 (requirement to furnish and file the Forms 1094-C and 1095-C) by employers with 50 or more full-time employees. In recognition of the challenges in the implementation of procedures to facilitate the preparation of forms and their timely distribution and filing, transition relief was available to entities who made a good faith effort to comply with respect to the reporting requirements for 2015. The relief was available only if the entity timely furnished or filed the required forms, but who either incorrectly completed or provided incomplete information on the forms. Notice 2016-70 extends this same transition relief for reporting required for 2016.

If you have any questions regarding the foregoing, please contact the author of this article.