JAHIZ NOEL AGARD and KATURI KAYE, April 27, 2023

Starting in June 2023, the Internal Revenue Service (the “IRS”) will start accepting determination letter applications for individually designed Internal Revenue Code Section 403(b) plans (“section 403(b) plans”) (also known as tax-sheltered annuity plans). As announced in Revenue Procedure 2022-40 (issued in November 2022), plan sponsors of such plans will have the limited opportunity to receive favorable determination letters from the IRS in the case of an initial plan determination, upon plan termination, and in certain other circumstances identified by the IRS in published guidance. With a favorable determination letter, a plan sponsor will have assurance that its section 403(b) plan document complies with the Internal Revenue Code (the “Code”). This article explains the parameters of this new opportunity for section 403(b) plans.

Background

A section 403(b) plan, the framework for which was established by law in 1958, is generally a defined contribution retirement plan for employees of certain tax-exempt organizations (i.e., Code section 501(c)(3) organizations), certain employees of public schools, and certain ministers or chaplains

While Code section qualified retirement plans, including other defined contribution plans (like Code section 401(k) plans), have historically (for decades) had access to the benefits of the IRS review process, section 403(b) plans generally have not. In fact, the term “qualified plan” technically excludes a section 403(b) plan. However, section 403(b) plans are broadly considered “qualified” retirement plans as opposed to “nonqualified” retirement plans (e.g., a Code section 457 or 409A plan).

In 2013, the IRS established a program for pre-approved section 403(b) plans (i.e., prototype and volume submitter plans) to be reviewed and receive an opinion letter from the IRS — but a similar mechanism was not provided for individually designed section 403(b) plans. Starting this year, however, the IRS has answered the call, and individually designed section 403(b) plans may now be submitted for review and receive favorable determination letters from the IRS. Note that the IRS makes clear that it will not issue determination letters for legacy individually designed section 403(b) plans that are: (1) TEFRA (Tax Equity and Fiscal Responsibility Act of 1982) church defined benefit plans, or (2) grandfathered plans under IRS Revenue Ruling 82-102.

Benefits of a Favorable Determination Letter

The sponsor of an individually designed section 403(b) plan is not required to apply for a determination letter from the IRS. However, having a favorable determination letter from the IRS provides the plan sponsor with reliance that its section 403(b) plan is qualified in form under the Code.

Moreover, with respect to the administration and operation of qualified retirement plans, auditors, attorneys, investment managers, insurers, recordkeepers, and other service providers to such plans often request copies of IRS opinion letters or favorable determination letters as part of their due diligence and audits. Without such a letter, a plan sponsor may be asked to make unsupported representations regarding the plan’s compliance with the Code. For the past decade, plan sponsors who adopted pre-approved section 403(b) plans have been able to rely on their IRS opinion letters. In the absence of such letters, however, plan sponsors of individually designed section 403(b) plans have had to provide explanations of their compliance with the Code.

With the availability of the determination letter process for individually designed section 403(b) plans, we anticipate that sponsors of such plans will start to see more routine requests from their service providers for determination letters. Thus, by going through the determination letter process, plan sponsors of individually designed section 403(b) plans will be able to rely on the assurances provided in the favorable determination letter from the IRS, similar to plan sponsors of pre-approved section 403(b) plans, thus streamlining the administration and audit process. That reliance will be particularly helpful in the case of the initial plan determination (which is the case for most individually designed section 403(b) plans) or the case of plan termination.

The Determination Letter Process Starting June 1, 2023

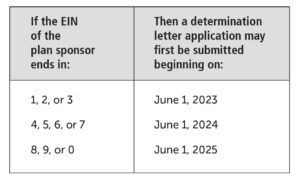

For an initial plan determination, the plan sponsor of an individually designed section 403(b) plan may file a Form 5300 (Application for Determination for Employee Benefit Plan), with timing based upon the plan sponsor’s employer identification number (EIN), in accordance with the following schedule:

Even though the earliest filing dates are staggered by EINs, there is no deadline to file for an initial plan determination. For example, if a plan sponsor’s EIN ends in a 1, that plan sponsor may file on June 1, 2023, or delay to a future date, such as in January 2026.

The IRS requires a restatement of the plan document at the time an application is submitted for an initial plan determination. The restatement should incorporate all previously adopted amendments.

For a determination upon plan termination, beginning on or after June 1, 2023, a plan sponsor of an individually designed section 403(b) plan may file a Form 5310 (Application for Determination for Terminating Plan), provided that the application must be filed no later than the later of: (1) one year from the effective date of the section 403(b) plan’s termination, or (2) one year from the date on which the action terminating the section 403(b) plan is taken. Additionally, the plan sponsor must file the application no later than 12 months from the date of distributing substantially all plan assets in connection with the plan termination.

There is no requirement for a restated plan document when a plan sponsor requests a determination letter upon plan termination.

For a determination upon certain other circumstances outside of an initial plan determination or plan termination, plan sponsors of individually designed section 403(b) plans will have to wait for further guidance from the IRS. Revenue Procedure 2022-40 provides that the IRS will consider annually whether a plan sponsor may file a determination letter application in other circumstances, such as significant law changes, new approaches to plan design, and the inability of certain types of plans to convert to pre-approved plan documents.

As with the IRS’s rules governing determination letter submissions for qualified plans, notice that a determination letter application is being filed for the individually designed section 403(b) plan must be provided to all interested persons. For details regarding this notice, please see: Revenue Procedure 2023-4, Section 19B. What Notice Requirements Apply To Interested Persons (§403(b) Plans Only)?

Scope of Plan Review Regarding Determination Letter Applications

Annually, the IRS publishes a “Required Amendments List” that documents changes in the requirements for qualified plans and section 403(b) plans. In reviewing an application for the initial determination of an individually designed section 403(b) plan, the IRS generally will consider only the changes in section 403(b) requirements that have been included on the Required Amendments List issued on or before the last day of the second calendar year before the year in which the determination letter application is submitted.

In reviewing an application for determination upon the termination of an individually designed section 403(b) plan, the IRS expects the plan sponsor to adopt any amendments required to maintain the plan in compliance with applicable law as of the date of termination, regardless of whether the requirements are included on a Required Amendments List.

Considerations for Plans Sponsors

While we welcome the new determination letter process for individually designed section 403(b) plans, we believe that several considerations should be assessed with legal counsel before proceeding, including the following:

Long-standing section 403(b) plans

Although section 403(b) plans have existed for over six decades, the IRS did not require plan sponsors to adopt written plan documents for section 403(b) plans until 2009. Thus, in reviewing a determination letter application for a long-standing section 403(b) plan, the IRS may uncover qualification defects that have been long baked into the plan’s design. As a result, we recommend that plan sponsors carefully review their plan documents and plan operation with legal counsel before requesting a favorable determination letter from the IRS, in order to determine if plan corrections need to be made.

Reliance on determination letters is not indefinite

A favorable determination letter means that the IRS has made a determination that the plan document, as reviewed by the IRS, is compliant with the Code. Thus, a plan sponsor may not continue to rely on a favorable determination letter for its individually designed section 403(b) plan with respect to any plan provision that is amended, or that is affected by a change in the Code section 403(b) requirements, following the date of the favorable determination letter.

No reliance concerning multiple unrelated employers

In the case of an individually designed section 403(b) plan that is not a governmental plan (within the meaning of Code section 414(d)), the IRS has made it clear that a favorable determination letter will not express an opinion, and may not be relied upon, with respect to whether the plan meets any requirements that apply due to the plan’s coverage of multiple unrelated employers (i.e., employers that are not in a single controlled group for purposes of Code section 414(b), (c), (m), or (o)). Similarly, with respect to an individually designed section 403(b) plan that is a governmental plan, the IRS has also clarified that a determination letter will not express an opinion, and may not be relied upon, with respect to whether the plan meets any requirements that apply due to the plan’s coverage of multiple unrelated employers (i.e., that are not aggregated in a single controlled group in a manner consistent with IRS Notice 89-23).

No review of plan mergers or consolidations

Although the IRS currently allows plan sponsors of individually designed qualified plans to receive favorable determination letters with respect to the merger or consolidation of two or more plans, the IRS is not offering this opportunity to plan sponsors of individually designed section 403(b) plans at this time. However, we are hopeful that the “certain other circumstances” to be identified by the IRS in future guidance will include such instances involving individually designed section 403(b) plans.

Overall, we welcome this new opportunity for plan sponsors of individually designed section 403(b) plans and look forward to working with them as they embark on the favorable determination letter journey for their section 403(b) plans for the first time.

For additional questions concerning this article, please contact the attorney that you regularly work with or the author of this article.