SHANNON OLIVER, December 15, 2021

On November 4, 2021, the Internal Revenue Service issued Notice 2021-61, containing the cost-of-living adjustments related to retirement plan limitations under the Internal Revenue Code (the “Code”). These changes will take effect on January 1, 2022. Below are some of the highlights.

I. Limitations That Have Increased

- The limitation on the annual benefit under a defined benefit plan is increased from $230,000 to $245,000 (Code section 415(b)(1)(A)).

- The annual contribution limitation for defined contribution plans is increased from $58,000 to $61,000 (Code section 415(c)(1)(A)).

- The annual compensation limit is increased from $290,000 to $305,000 (Code sections 401(a)(17), 404(l),408(k)(3)(C) and 408(k)(6)(D)(ii)).

- The limitation under Code section 402(g)(1) on the exclusion for elective deferrals described in section 402(g)(3) is increased from $19,500 to $20,500.

- The annual compensation limitation under section 401(a)(17) for eligible participants in certain governmental plans that, under the plan as in effect on July 1, 1993, allowed cost-of-living adjustments to the compensation limitation under section 401(a)(17) to be taken into account, is increased from $430,000 to $450,000.

- The dollar limitation regarding the definition of “key employee” in a top-heavy plan increased from $185,000 to $200,000 (Code section 416(i)(1)(A)(i)).

- The dollar amount for determining the maximum account balance in an employee stock ownership plan subject to a 5-year distribution period is increased from $1,165,000 to $1,230,000, while the dollar amount used to determine the lengthening of the 5-year distribution period is increased to $245,000, up from $230,000 in 2021 (Code section 409(o)(1)(C)(ii)).

- The limitation used in the definition of “highly compensated employee” is increased from $130,000 to $135,000 (Code section 414(q)(1)(B)).

- The adjusted gross income limitation under Code section 25B(b)(1)(A) for determining the retirement savings contribution credit for married taxpayers filing a joint return is increased from $39,500 to $41,000; the limitation under Section 25B(b)(1)(B) is increased from $32,250 to $33,000; the limitation under Code sections 25B(b)(1)(C) and 25B(b)(1)(D) is increased from $49,500 to $51,000.

- The adjusted gross income limitation under Code section 25B(b)(1)(A) for determining the retirement savings contribution credit for taxpayers filing as head of household is increased from $29,625 to $30,750; the limitation under Section 25B(b)(1)(B) is increased from $32,250 to $33,000; the limitation under Code sections 25B(b)(1)(C) and 25B(b)(1)(D) is increased from $49,500 to $51,000.

- The adjusted gross income limitation under Code section 25B(b)(1)(A) for determining the retirement savings contributions credit for all other taxpayers is increased from $19,750 to $20,500; the limitation under Code section 25B(b)(1)(B) is increased from $21,500 to $22,000; and the limitation under Sections 25B(b)(1)(C) and 25B(b)(1)(D) is increased from $33,000 to $34,000.

- The limitation under Code section 408(p)(2)(E) regarding SIMPLE retirement accounts is increased from $13,500 to $14,000.

- The limitation on deferrals under Code section 457(e)(15) concerning deferred compensation plans of state and local governments and tax-exempt organizations is increased from $19,500 to $20,500.

- The compensation amount under Code section 1.61-21(f)(5)(i) of the Income Tax Regulations concerning the definition of “control employee” for fringe benefit valuation purposes is increased from $115,000 to $120,000; the compensation amount under Code section 1.61-21(f)(5)(iii) is increased from $235,000 to $245,000.

- The dollar threshold the Code utilizes to determine whether a multiemployer plan is a systematically important plan is adjusted using the cost-of-living adjustment. After taking the applicable rounding rule into account, the threshold is increased from $1,176,000,000 to $1,220,000,000. (Code sections 432(e)(9)(H)(v)(lll)(aa) and 432(e)(9)(H)(lll)(bb)).

- The dollar limitation on premiums paid with respect to a qualifying longevity annuity contract under Code section 1.401(a)(9)-6, A-17(b)(2)(i) of the Income Tax Regulations is increased to $145,000 from $135,000 in 2021.

- The limitation concerning the qualified gratuitous transfer of qualified employer securities to an employee stock ownership plan is increased from $50,000 to $55,000 (Code section 664(g)(7).

II. Limitations That Remain Unchanged

- The deductible amount for an individual making qualified retirement contributions remains $6,000. (Code section 219(b)(5)(A)).

- The compensation amount under Code section 408(k)(2)(C) regarding simplified employee pensions (SEPs) remains at $650.

- The maximum amount of catch-up contributions individuals aged 50 or over may make to 401(k) plans, 403(b) plans, SEPs, and governmental 457(b) plans remains unchanged at $6,500 (Code section 414(v)(2)(B)(i)).

- The maximum amount of catch-up contributions that individuals aged 50 or over may make to 401(k) plans, 403(b) plans, SEPs, and governmental 457(b) plans remains unchanged at $6,500 (Code section 414(v)(2)(B)(i)). The maximum amount of catch-up contributions that individuals aged 50 or over may make to SIMPLE 401(k) plans or SIMPLE retirement accounts remains at $3,000 (Code section 414(v)(2)(B)(ii)).

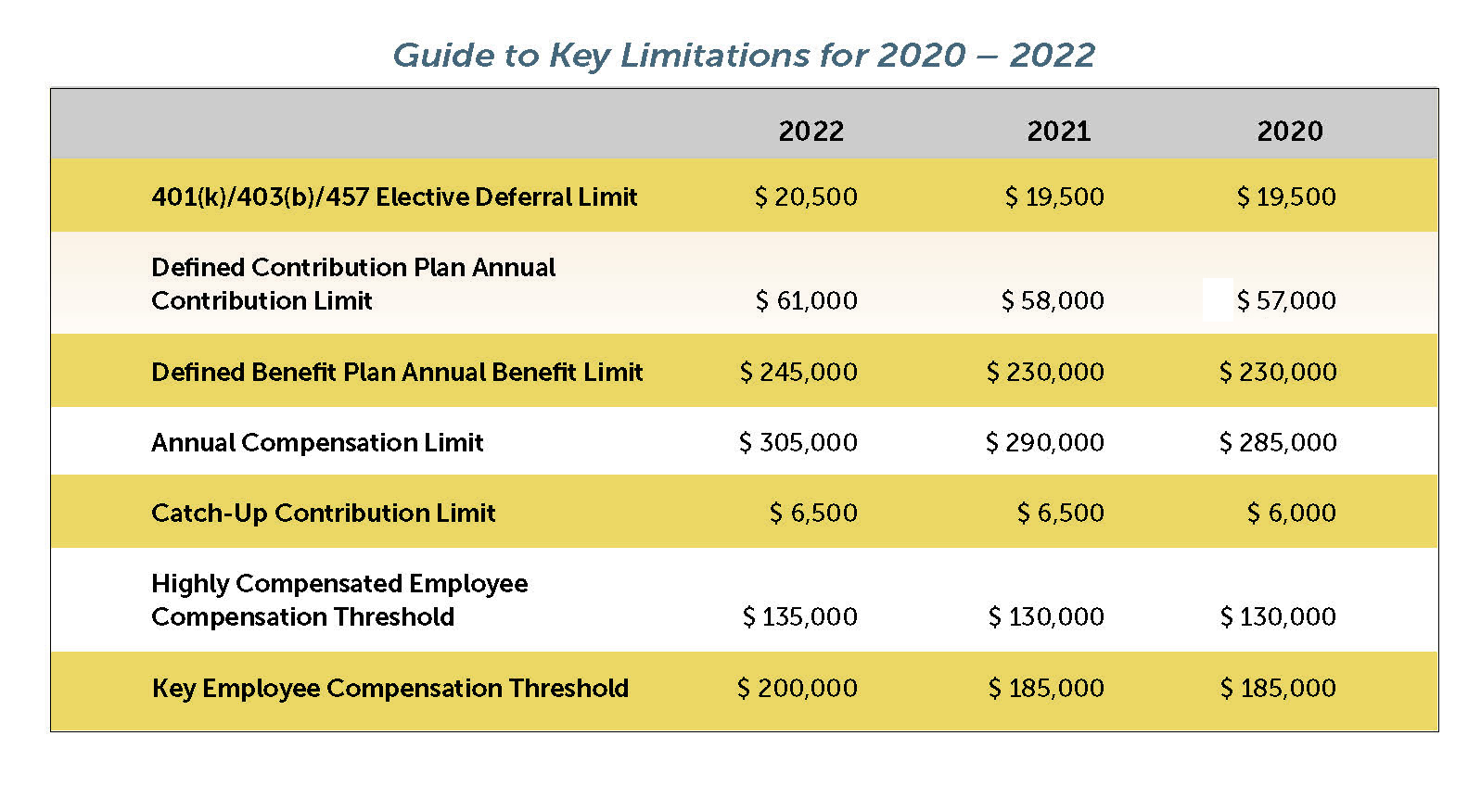

The following is a quick reference guide to key limitations for 2020-2022.