BARBARA PLETCHER, March 2016 –

We are seeing a renewed interest in derisking of defined benefit pension plans by implementing a “lump sum window,” and wanted to share with you the employee communication below. For purposes of this article, a “lump sum window” is a limited period of time during which participants in a defined benefit pension plan can elect to receive their pension plan benefit in the form of an immediate lump sum or as an immediate annuity. Participant disclosures associated with such lump sum windows are receiving increased scrutiny because legislators (and others) are concerned that defined benefit pension plan participants do not understand the consequences of electing an immediate lump sum.1

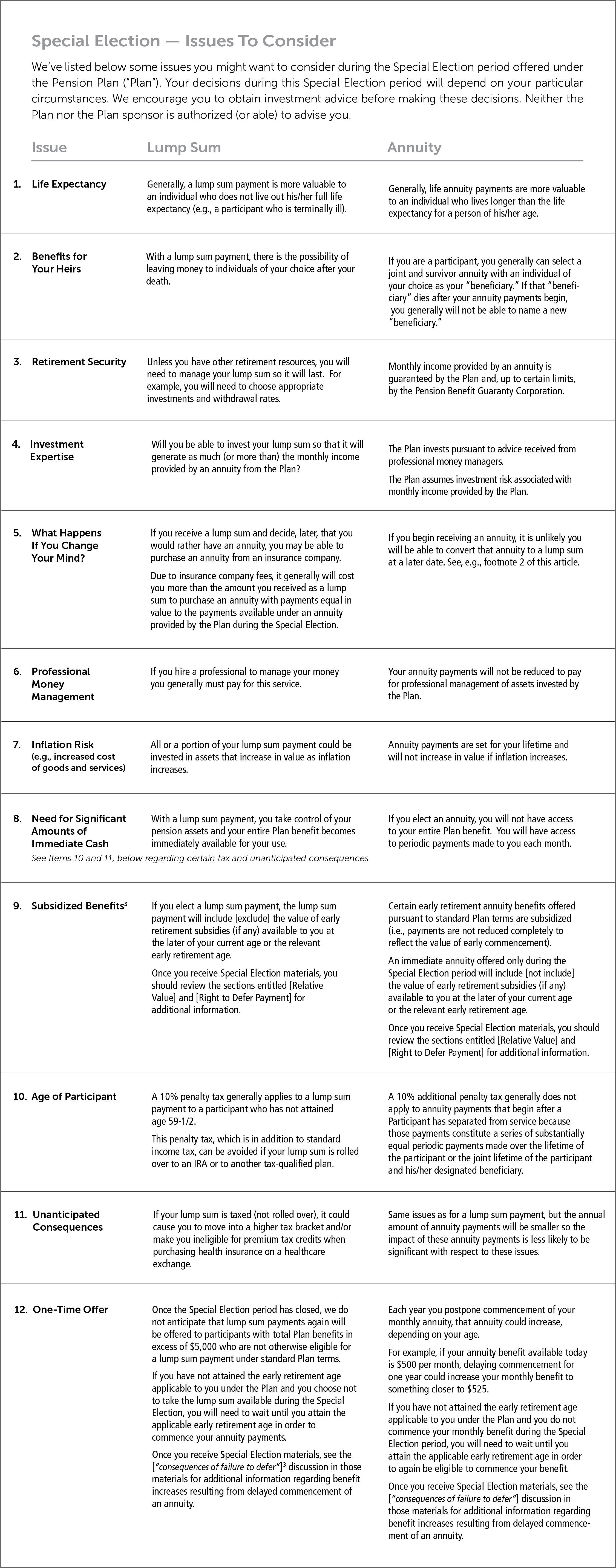

The employee communication below is designed to help participants who have separated from employment, but who have not yet begun to receive their pension2 make an informed decision when presented with the opportunity, during a lump sum window (referred to in the communication as a “Special Election”), to receive an immediate lump sum payment or to commence immediate annuity payments. Such an employee communication would supplement (not replace) legally required communications distributed as part of the normal benefit election process.

A

………………………………………..

1 See, e.g., United States Government Accountability Office, Report to the Ranking Member, Committee on Ways and Means, House of Representatives entitled “Participants Need Better Information When Offered Lump Sums That Replace Their Lifetime Benefits.” (January 2015)

2 See, e.g., IRS Notice 2015-49 (announcing the intent of the Department of Treasury and the Internal Revenue Service to prohibit lump sum offers to participants already in pay status).

3 Bracketed language would need to be edited to be consistent with plan document language and legally required disclosures provided by the plan to plan participants.