JAHIZ AGARD and SHANNON OLIVER, December 2015 —

On December 28, 2015, with deadlines looming, the Internal Revenue Service (“IRS”) released Notice 2016-4, extending the due dates for the information reporting required under Sections 6055 and 6056 of the Internal Revenue Code (the “Code”). Of significance to employers, the deadlines for furnishing the 2015 Forms 1095-C to employees has been extended by two months, from February 1, 2016 to March 31, 2016, and for electronically filing the Forms 1095-C and Form 1094-C with the IRS from March 31, 2016 to June 30, 2016 (a three-month extension). These new due dates also apply to providers of health coverage (such as multiemployer plans that provide self-insured coverage and insurers) for the furnishing of the Forms 1095-B to covered individuals and for the filing of the Forms 1095-B and Form 1094-B with the IRS. Note: Because the extensions provided in the notice apply automatically and are more generous than the extensions described in previous guidance, the notice states that the IRS will not grant any extension that is requested by a filer pursuant to such prior guidance with respect to any information reporting due concerning 2015 coverage.

Background

Under the Affordable Care Act (“ACA”), employers are generally subject to the “employer-shared responsibility” provision under Code Section 4980H (i.e., requirement to offer health coverage to full-time employees and their dependents) and individuals are generally subject to the “individual-shared responsibility” provision under Code Section 5000A (i.e., individual taxpayer obligation to maintain health coverage). To help the IRS administer these requirements and the premium tax credit for Marketplace/Exchange coverage under Code Section 36B, Code Sections 6055 and 6056 require providers of health coverage (e.g., insurers and certain multiemployer plans) and employers with 50 or more full-time employees, respectively, to provide health coverage information to individuals and the IRS. [See August 2015 and September 2015 for further details about the information reporting requirements.] This information must be provided on the following forms:

Providers of Coverage

- Form 1094-B — Transmittal of Health Coverage Information Returns (file with IRS along with Forms 1095-B)

- Form 1095-B — Health Coverage (provide to each covered individual and file with IRS)

Employers (generally, employers with 50 or more full-time employees, including full-time equivalents)

- Form 1094-C — Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns (file with IRS along with Forms 1095-C)

- Form 1095-C — Employer-Provided Health Insurance Offer and Coverage (provide to each full-time employee and file with IRS)

New Distribution and Filing Deadlines

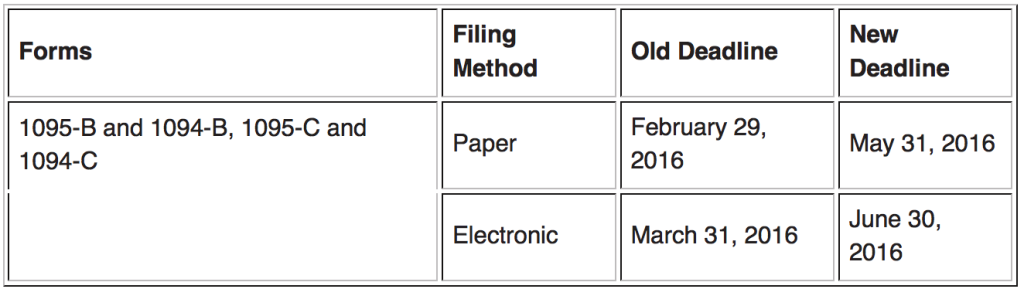

The following charts show the old and new deadlines applicable for the 2015 calendar year.

Deadline to Distribute Forms to Employees and Other Individuals (e.g., retirees):

Deadline to File Forms with the IRS:

Penalties

Employers or coverage providers that do not meet the above deadlines are subject to penalties under Code Sections 6722 or 6721 for failing to timely distribute or file correct/complete ACA information reporting forms, as applicable. In prior guidance, the IRS stated that penalties will not be imposed on employers or coverage providers that can show that they have made good faith efforts to comply with the ACA information requirements. However, this relief only applies to the distribution or filing of incorrect or incomplete information — not to any failure to timely distribute or file a form. If any of the above referenced forms are not timely filed or furnished, the penalty may be waived by the IRS if the failure is due to reasonable cause — that is, the coverage provider or employer shows that it acted in a responsible manner and the failure is due to significant mitigating factors or events beyond the control of the employer or coverage provider. In Notice 2016-4, the IRS encourages employers and coverage providers to distribute and file the forms even after the extended deadlines because such action, along with evidence of readiness to comply with ACA reporting requirements for 2016 (due in 2017), will be taken into consideration when determining whether to reduce or waive any penalty for reasonable cause.

Impact to Individual Taxpayers

In the notice, the IRS states that individual taxpayers who are enrolled in employer-sponsored health coverage generally will not be affected by the extension and should be able to file their tax returns as they normally would.

If you have any questions regarding this article, please contact the authors.