YATINDRA PANDYA and ROBERT GOWER, June 27, 2024

Introduction

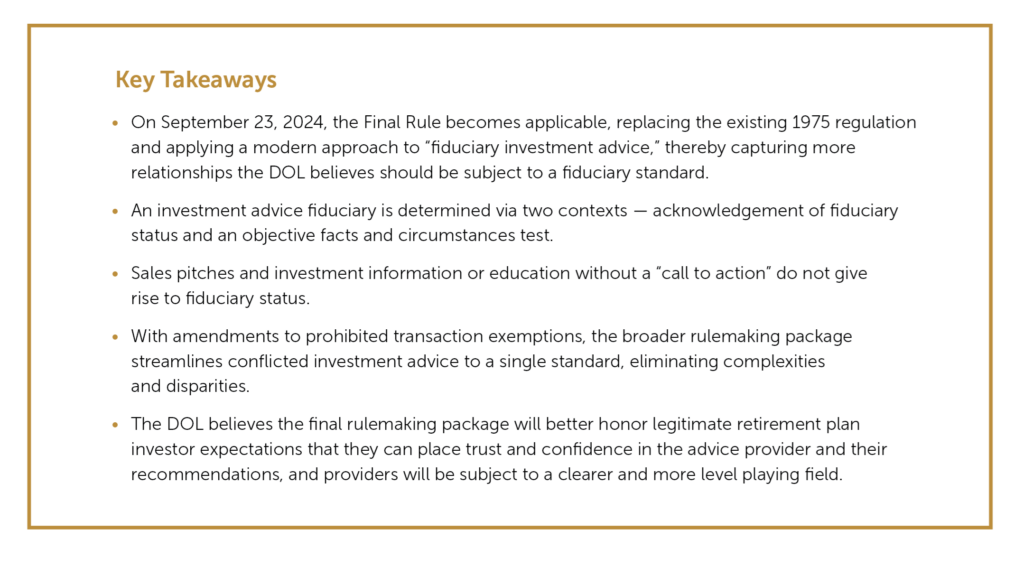

On April 25, 2024 the Department of Labor (DOL) issued the final Retirement Security Rule (the “Final Rule”), providing a new regulatory definition of an “investment advice fiduciary” under the Employment Retirement Income Security Act of 1974 (ERISA). The Final Rule looks to end the DOL’s decades-long effort to replace the 1975 definition of who may be considered a fiduciary when providing investment advice for a fee or other compensation. In 2010, a proposed rule was withdrawn by the DOL. A 2016 final rule (the “2016 fiduciary rule”) was vacated by the Fifth Circuit Court of Appeals in 2018, leaving as the rule a five-part regulatory test issued a year after enactment of ERISA (the “1975 regulation”). For discussion on background leading up to the Final Rule, see our November 30, 2023 article, “Retirement Security Rule: Definition of an Investment Advice Fiduciary & Proposed Amendment to Prohibited Transaction Exemption 2020-02”.

The Final Rule directly addresses concerns raised by the Fifth Circuit Court of Appeals that led to the demise of the 2016 fiduciary rule by applying a context-based approach that includes an objective facts and circumstances test as to what constitutes fiduciary advice. In addition, in response to industry reaction to the Proposed Rule, the DOL made certain changes and clarifications in the Final Rule. Through these efforts, the DOL believes that, compared to the 1975 regulation, the Final Rule better reflects the text and the purposes of ERISA and better protects the interests of retirement investors by applying itself narrowly to trusted advice relationships. According to the DOL, part of the reason the 1975 regulation allows so many advice providers to avoid fiduciary status is that the retirement marketplace has changed dramatically since 1975 when defined benefit plans predominated and participant-directed defined contribution plans had barely come into being. To illustrate this shift, by the first quarter of 2022 the assets held by defined contribution plans and IRAs outnumbered defined benefit plans by $21.4 trillion to $3.7 trillion. Furthermore, the DOL notes particular concern with assigning fiduciary status to recommendations of rollovers to IRAs:

“The decision to roll over assets from a plan to an IRA is often the single most important financial decision a plan participant makes, involving a lifetime of retirement savings.”

In 2020, more than ninety-five percent of all flows into IRAs came from defined contribution plans, and between 2022 through 2027, $4.5 trillion in assets held in defined contribution plans is projected to be rolled over to IRAs. Now, a little under half-way through that period, plan fiduciaries, advisors, and investors still must rely on the 1975 regulation, which includes numerous loopholes.

This article outlines the DOL’s objectives and enhancements to the definition of fiduciary investment advice in the Final Rule, and how it differs from the Proposed Rule and vacated 2016 fiduciary rule. The article also discusses the Final Rule’s potential impact on investors and investment professionals who are currently subject to the existing regulatory landscape (the 1975 regulation). The article also addresses related prohibited transaction exemptions which form the regulatory package, and how the package aims to level the playing field and provide clear and equal application of fiduciary protections in rendering investment advice.

Part I: The Final Rule

The Final Rule provides updated criteria to determine whether an advice provider is an investment advice fiduciary under ERISA, and therefore subject to ERISA’s fiduciary standards. The analysis begins with a threshold question as to whether a person makes a compensated recommendation of any securities transaction or other investment transaction or any investment strategy involving securities or other investment property to a retirement investor. If the answer to that question is yes, then such advisor must satisfy either of the two contexts below with respect to that recommendation. If the advisor satisfies either context, they are an investment advice fiduciary because they render compensated “investment advice” with respect to property of the plan. The two contexts are:

- Facts and circumstances test: The person either directly or indirectly (e.g., through or together with any affiliate) makes professional investment recommendations to investors on a regular basis as part of their business and the recommendation is made under circumstances that would indicate to a reasonable investor in like circumstances that the recommendation

— is based on review of the retirement investor’s particular needs or individual circumstances,— reflects the application of professional or expert judgment to the retirement investor’s particular needs or individual circumstances, and— may be relied upon by the retirement investor as intended to advance the retirement investor’s best interest. - Acknowledgement of fiduciary status: The person represents or acknowledges that they are acting as a fiduciary under ERISA with respect to the recommendation.

Notably, the DOL departed from a three-prong approach in the Proposed Rule by omitting the context regarding discretionary authority or control. That context would automatically treat recommendations from persons who have discretionary authority or control over the retirement investor’s assets as fiduciary investment advice, provided the other parts of the test were satisfied. This would have been an expansion of the discretionary authority or control prong of the 1975 regulation, from “securities or other property of the plan” to “securities or other property of the Retirement Investor”. In omitting this provision entirely, the DOL acknowledged commenters on the Proposed Rule, stating the general approach of a facts and circumstances test would more appropriately define an investment advice fiduciary and would likely include, to a more targeted extent, parties with investment discretion.

Other notable changes and clarifications made under the Final Rule:

Written Disclaimers

A written disclaimer as to an advisor’s fiduciary status does not control to the extent that it is inconsistent with the person’s oral communications, marketing materials, applicable State or Federal law, or other interactions with the retirement investor. In other words, a written disclaimer is not determinative as to fiduciary status, but it is also not prohibited. The DOL notes that weight will be given to a disclaimer to the extent that it is consistent with the parties’ interactions.

Retirement Investor

The Final Rule added a new defined term, retirement investor, and an investment advice fiduciary is not included in that definition. This should alleviate some concern related to the flow of information in the institutional marketplace, in which advice providers may provide advisory tools to fiduciaries who, in turn, render investment advice to retirement investors.

Recommendation

The DOL did not define the term “recommendation”; instead, it provided the meaning of the phrase “a recommendation of any securities transaction or other investment transaction or any investment strategy involving securities property or other investment property” to include the following:

- Recommendations involving securities, other investment property, and investment strategies, including recommendations as to how securities or other investment property should be invested after rollover, transfer, or distribution; and including recommendations on rollovers, benefit distributions, or transfers from plans or IRAs.

- Recommendations on management of securities or other investment property, and account types, including recommendations on the selection of other persons to provide investment advice or investment management; and recommendations regarding proxy voting appurtenant to ownership of shares of corporate stock.1

The DOL further confirmed that the determination of whether a recommendation is made will be construed consistent with the SEC Regulation Best Interest, which includes factors such as whether the recommendation can reasonably be viewed as a call to action, whether the recommendation reasonably would influence an investor to trade a security, and how tailored the recommendation is to a specific individual or group. Absent a call to action, there is no recommendation and by definition, no fiduciary investment advice.

Sales Pitches and Investment Education

Normal marketing activity is not a recommendation. What would have been the third context from the Proposed Rule is now a provision that stands for the proposition that a recommendation is not “investment advice” if it is made outside of the two contexts in which a recommendation becomes fiduciary investment advice. Although stated generally, and some might say in an unnecessarily tautological manner, the DOL uses this provision to clarify that communications that are sales pitches or investment information/education do not fix fiduciary status if such communication falls outside of the Final Rule’s two specified contexts. The Final Rule clarifies that what makes a sales pitch a recommendation is a call to action. Similarly, the line between investment information or education and a recommendation depends on whether there is a call to action. Should a recommendation occur as part of a sales pitch, it is evaluated separately and may be fiduciary investment advice if it meets either context. That is to say, a sales pitch cannot shield a recommendation from becoming fiduciary investment advice.

Facts and Circumstances Test

The first context in the Final Rule is an objective facts and circumstances test based on reasonableness. This replaces the five-part test in the 1975 regulation with an updated test that advances the DOL’s objectives of closing various loopholes in that regulation, as well as responding to the Fifth Circuit concerns in Chamber, and surviving similar challenges going forward.

- “Reasonable investor in like circumstances”: In response to commenters who questioned whether the facts and circumstances test was subjective or objective, the DOL included the phrase in like circumstances to clarify that such test should indeed be evaluated on an objective basis. As a result, the test takes into account the circumstances of the investor, which could result in different outcomes depending on the nature of the investor. For example, a sophisticated investor may be evaluated differently from a retail investor as to what they reasonably would understand based on the interaction with the advisor.

- “Regular basis”: The regular basis requirement does not preclude one-time advice if the advisor regularly makes investment recommendations to other investors and the regulation’s other conditions are met.

- “…serve as the primary basis for investment decisions”: In keeping with the Proposed Rule, the DOL dropped “primary” — stating, as an example, that a plan fiduciary should be able to rely upon any or all of the consultants that it hired to render advice, regardless of arguments about whether one could characterize the advice, in some sense, as primary, secondary, or tertiary.

- “Best interest”: the DOL clarifies that use of the term “best interest” in the last prong of the facts and circumstances test is meant colloquially, and not meant to refer back to elements of the precise regulatory or statutory definitions of prudence or loyalty.

- “For a fee or compensation”: Advice for a fee or other compensation is applicable only if the fee or other compensation would not have been paid but for the recommended transaction or the provision of advice, including if the investment advice provider’s eligibility for the compensation (or its amount) is based in whole or in part on the recommended transaction or the provision of advice.

Related Amendments to Prohibited Transaction Exemption 2020-02

Amendments to PTE 2020-02 were part of a wider regulatory package that included amendments to PTE 84-24 as well as other PTEs broadening the reach of a uniform standard to prohibited transaction relief among investment advisors.

The final amendments to PTE 2020-02, which focus on fiduciary standards in providing investment advice related to rollovers, expanded coverage to transactions involving pooled employer plans and robo-advice transactions. In addition, amended PTE 2020-02 updated its impartial conduct standards to require a separate Care Obligation and Loyalty Obligation, similar to regulatory efforts under SEC Regulation Best Interest and the Investment Advisors Act. With that change, investment advice fiduciaries must provide certain disclosures to the advice recipient, including a fiduciary acknowledgment, a relationship and conflict of interest disclosure, and a rollover disclosure. With respect to rollover cases, the advisor must provide the retirement investor with information sufficient to understand what they are giving up in their employer-sponsored plan, as well as what they may gain from rolling over their retirement savings to an IRA. The provision of such information comes in the form of a rollover disclosure. Specifically, the disclosure is required where advice is rendered to roll over assets from an employer-sponsored plan, and also if a recommendation is made regarding the post-rollover investment of assets currently held in an employer-sponsored plan. Because the disclosure compares certain information from the employer-sponsored plan and the destination IRA, the advice provider will inevitably seek out such information on the employer-sponsored plan. From its discussion in the preamble, it does not appear the DOL expects the requirement for a rollover disclosure to place an extra burden on plan sponsors, fiduciaries, or their administrators. Instead, the DOL reminds investment professionals that necessary plan information is readily available in, for example, a 404(a)-5 disclosure, or if that is not the case, the investment professional may make reasonable assumptions based on the plan’s most recent Form 5500.

Part II: Impact of the Final Rule

The Final Rule will replace the 1975 regulation on September 23, 2024. Under the 1975 regulation’s five-part test, a person is a fiduciary only if they: (1) render advice as to the value of securities or other property, or make recommendations as to the advisability of investing in, purchasing, or selling securities or other property (2) on a regular basis (3) pursuant to a mutual agreement, arrangement, or understanding with the plan or a plan fiduciary that (4) the advice will serve as a primary basis for investment decisions with respect to plan assets, and that (5) the advice will be individualized based on the particular needs of the plan/participant. The Final Rule signifies the DOL’s overall dissatisfaction with the 1975 regulation, which it contends over time worked to defeat, rather than honor, legitimate investor expectations that they can place trust and confidence in the advice provider and their recommendations. Under the five-part test, the DOL found that many investment professionals, consultants, and financial advisors have no fiduciary obligation under ERISA despite the critical role they play in guiding plan and IRA investments. After September 22nd, plan sponsors, participants and fiduciaries are likely to encounter new scenarios that constitute fiduciary investment advice. While most of the burden of the Final Rule’s changes fall on investment professionals and their financial institutions, plan sponsors, fiduciaries and participants should be aware of new circumstances giving rise to fiduciary status and understand when an advisor is considered to be acting in a fiduciary capacity.

One-time advice can be fiduciary investment advice and is not evaluated any differently under the Final Rule solely because it was provided to a retirement investor only once. This principal is most apparent with the Final Rule’s elimination of the 1975 “regular basis…” prong, by transitioning to the standard “…as part of their business.” The updated language is intended to exclude persons outside of the financial services industry who may engage in isolated communications that could fit the definition of a covered recommendation but would not generally be understood as professional investment advice. This works both to overcome concerns the rule would sweep too broadly, and at the same time does not automatically exclude one-time advice from treatment as fiduciary investment advice. The latter is central to the DOL’s increased concern with non-fiduciary advice related to rollovers.

Similarly, the DOL maintained its removal of “primary basis” from the regulatory text. The Final Rule more directly addresses what the “primary basis” language may have sought to achieve through its change to the “regular basis” prong discussed above, in that, only those who provide investment advice as part of their regular business are fiduciaries under the rule.

Written disclaimers cannot be used as a means of avoiding ERISA fiduciary status. Disclaimers are not prohibited, but instead given weight in a facts and circumstances analysis and may be useful in scenarios such as a request for proposal, or the provision of investment education. However, by and large, the Final Rule makes written disclaimers of fiduciary status far less relevant.

As discussed above, a call to action delineates when a sales pitch or investment information or education becomes a recommendation. Coupled with clarification that a “hire me” communication without more is not a recommendation, the Final Rule makes meaningful efforts to expand coverage beyond the 1975 regulation, while seeking to address Fifth Circuit concerns that the DOL’s 2016 fiduciary rule went impermissibly beyond regulating trusted advice relationships.

An objective reasonableness standard from the perspective of the retirement investor replaces the requirement that the parties must have a mutual understanding. No longer is it relevant to consider whether the advisor and the investor are aligned with respect to the investment advice, or the understanding of the advisor as to their role in the interaction.

Carve-outs. The DOL reiterates that it carefully considered the Fifth Circuit’s decision, noting that the use of regulatory carve-outs and special provisions in the 2016 fiduciary rule was criticized as overly broad. For example, a carve-out is not available to sophisticated investors, who are evaluated under the facts and circumstances test.

Part III: Designed for Permanency?

The DOL provided a direct assessment of commenters who assert the Final Rule is mere repetition of the 2016 fiduciary rule.

“… commenters err in asserting that this rulemaking is simply a repeat of the 2016 Rulemaking, or in contending that the final rule fails to take proper account of the nature of the relationship between the advice provider and the advice recipient.”

The tenor of the preamble to the Final Rule reflects the DOL’s firmly held beliefs with respect to expanding the definition of fiduciary investment advice, but at the same time is conciliatory in terms of industry and public concerns as well as the Fifth Circuit vacatur. With that, the DOL hopes to convey that the Final Rule and the regulatory context are streamlined and more narrowly tailored than the 2016 fiduciary rule vacated by the Fifth Circuit, with a clear focus on relationships of trust and confidence, as listed below:

- The Final Rule and associated PTEs, unlike the 2016 fiduciary rule, contain no contract or warranty requirements. The 2016 fiduciary rule required that advisors and financial institutions give their customers enforceable contractual rights.

- The amended PTEs, unlike the 2016 fiduciary rule, do not prohibit financial institutions and advisors from entering into class-wide binding arbitration agreements with retirement investors.

- PTE 2020-02, as finalized, specifically provides an exemption from the PTE rules for pure robo-advice relationships, unlike the 2016 fiduciary rule.

- PTE 84-24, unlike the 2016 fiduciary rule, does not require insurance companies to assume fiduciary status with respect to independent insurance agents — an important concern of insurers with respect to the 2016 fiduciary rule.

- Neither PTE 2020-02 nor PTE 84-24, as amended, requires financial institutions to disclose all their compensation arrangements with third parties on a publicly available website, as was required by the 2016 fiduciary rule.

Overall changes to address concerns of overbreadth

In the preamble, the DOL recounted its changes to address concerns from commenters (and in response to the Fifth Circuit opinion regarding the 2016 fiduciary rule) that its Final Rule would be overbroad. Those changes include:

- Confirmation that whether a recommendation has occurred will be interpreted consistent with the SEC’s framework;

- Elimination of the provisions in the Proposed Rule that extended fiduciary status based on discretionary authority or control beyond just the plan to the retirement investor;

- Changes to the contexts giving rise to fiduciary status intended to keep them narrow and objective;

- Adoption of a new regulatory provision that confirms that sales recommendations that are not made in circumstances that satisfy the facts and circumstances test, or where fiduciary status has been specifically acknowledged, will not result in investment advice fiduciary status;

- Providing that investment information or education, without an investment recommendation, is not advice for purposes of the Final Rule; and

- Revision of the definition of a ‘‘retirement investor’’ to exclude plan and IRA fiduciaries that are investment advice fiduciaries.

Legal Challenges

On May 2, only weeks after the Final Rule was published, a lawsuit challenging the Final Rule was filed by the Federation of Americans for Consumer Choice in the U.S. District Court for the Eastern District of Texas. The case (which is, not surprisingly, arising in the Fifth Circuit) postures that the Final Rule covers the same professionals and transactions, and is substantively the same as the “overly broad” 2016 fiduciary rule. Just last week, the DOL responded with a brief, stating that the Final Rule is distinct from the 2016 fiduciary rule in that it focuses on how advisors present themselves in the relationship with the investor, and that the Final Rule does not create new contractual requirements establishing fiduciary status or place limits on mandatory arbitration.

A substantially similar suit was filed in the Northern District of Texas by the American Council of Life Insurers on May 24. If either or both suits survive, the future of litigation may depend on the outcome of the 2024 presidential election.

_______________

1 However, guidelines or other information on voting policies for proxies that are provided to a broad class of investors without regard to a client’s individual interests or investment policy, and that are not directed or presented as a recommended policy for the plan or IRA to adopt, would not rise to the level of a covered recommendation under the rule.